Bookkeeping

How To Start A Bookkeeping Business 2023 Guide

You’re not actually making or losing any money—it’s just in a new place. Any money or investments (like equipment and property) coming in from the owner of the business (so, probably you!) goes under equity. As procrastination-worthy as it may seem, bookkeeping is a necessary part of successfully running your business.

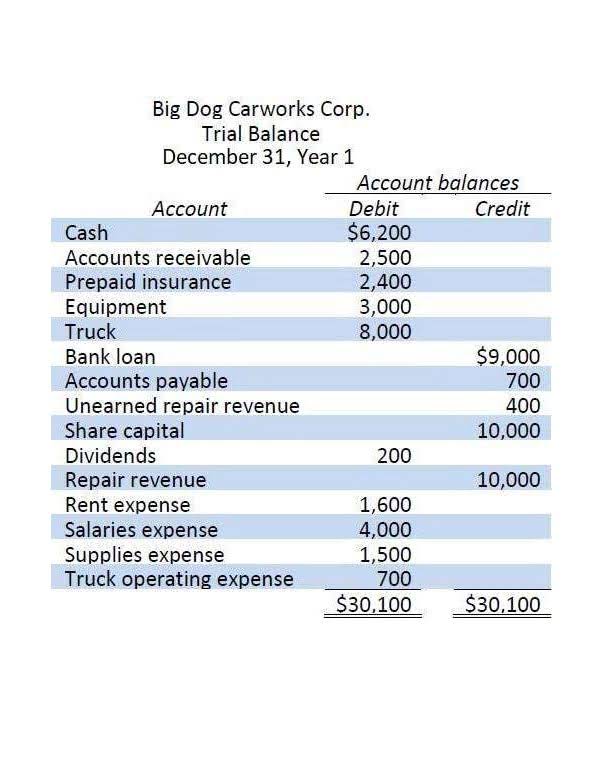

When you do your books, the retained earnings account is one which tracks your company’s profits that you reinvest into the business and don’t keep for yourself or pay out to other owners. To do the books for your small business, you need to be aware of all of the different account types. These include accounts payable, inventory, cash and many more that we’ve outlined in this blog.

How Much Should I Charge My Bookkeeping Clients?

Meaning, to monitor income long term, you need to watch your receivables closely. Now that you’ve chosen and set up your system, it’s time to create processes. Add descriptors (like account number and account name) bookkeeping examples for small business as shown in the example below, and voilà! You have a robust Chart of Accounts, something that would impress any accountant. The typical view, however, is to group records by category (sometimes called “codes”).

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. If you use cash accounting, you record your transaction when cash changes hands.

How To Start A Bookkeeping Business (2023 Guide)

So set aside a time at the end of each week (or a few times each week) to review your app’s work and look over your financial reports. Revenue is all the income a business receives in selling its products or services. Costs, also known as the cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account on the chart of accounts tracks goods purchased. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system.

When a sales invoice is issued in accounting software, it will have either two or three posts, depending on if you are VAT registered. The first thing to do is decide how you will complete the bookkeeping. Some businesses use manual systems like Excel, while others opt for accounting software. Unlike certified public accountants, bookkeepers don’t file tax returns or audit financial statements. Unless they are a certified public accountant (CPA), bookkeepers should not prepare tax returns or sign the returns as a paid preparer.

Monthly Bank Reconciliation Template

Accounts receivable (AR) is pretty much the exact opposite of accounts payable. If you sell a product or service and you don’t collect payment immediately, then your small business has receivables which you track in this account. We get it, it always hurts a little inside when you have to spend money in your business. However, accounts payable gives you a much clearer view of everything you spend. Think of this account as one that represents the money that your business owes in the form of bills and invoices from vendors.

Emoji for expenses, penthouses and slipshod accounting: The most damning details from new FTX CEO’s report – CNBC

Emoji for expenses, penthouses and slipshod accounting: The most damning details from new FTX CEO’s report.

Posted: Thu, 17 Nov 2022 08:00:00 GMT [source]

This is the first place computerized business transactions are entered. So this Bank Transactions window is kind of like your Journal or your Cashbook. Another way to look at tracking business transactions through the bank is to keep a cash book.

Customize account titles and categories as needed to reflect your specific business. On this page, you’ll find many bookkeeping templates, including a cash book template, a business expense spreadsheet, a statement of account template, and an income statement template. Accounting software can streamline your bookkeeping process and make your financial management more efficient. It’s useful for business owners looking to save time and avoid common accounting errors.

- The next step in learning how to keep books for small business is to understand your responsibility to pay sales tax.

- For instance, you may need to obtain workers’ compensation insurance.

- It lets you know if your business is making money at a healthy pace, or if you might be struggling to stay afloat soon.

- Trying to juggle too many things at once only works to put your organization in danger.

- Most companies use computer software to keep track of their accounting journal with their bookkeeping entries.

This is what you need to send to your customers at the end of the month. Depending on which software solution you choose (see step 3), you’ll do this manually, or you’ll automate it. If you organize those categories into a table, you have a (title cased) Chart of Accounts. Of the other important bookkeeping terms you should learn, there are two to memorize from the get go. The first step is to familiarize yourself with some essential bookkeeping concepts. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.